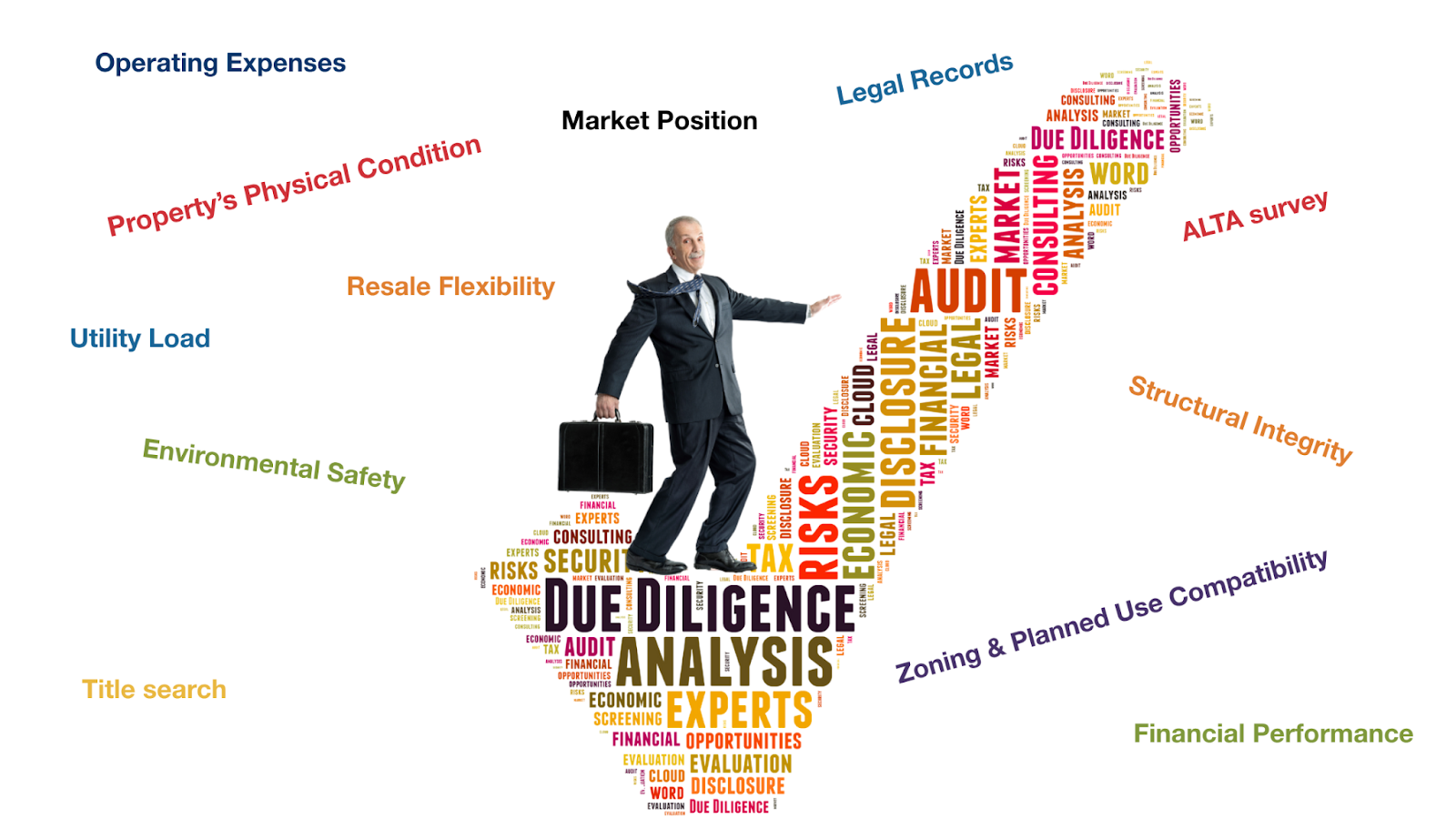

Buying a commercial property is a significant investment—and due diligence is where the real decision-making happens. Whether you’re purchasing for your business, expanding your portfolio, or evaluating an income-producing property, this phase ensures that what you see on the surface aligns with the reality beneath it.

At The Bill Gladstone Group, we’ve guided buyers across Dauphin, Cumberland, Perry, Lebanon, and York Counties through this process for decades. Below is a step-by-step due diligence checklist to help you evaluate a property with clarity and confidence—before signing.

1. Understand the Property’s Physical Condition

A complete review of the building’s physical systems helps you anticipate upcoming expenses.

Check:

- Roof age, warranty, and condition

- HVAC system age, maintenance history, and performance

- Electrical capacity and panel load

- Plumbing and drainage conditions

- Fire suppression & alarm systems

- ADA compliance and access points

- Parking lot structure, lighting, and resurfacing needs

Professional Reference for Building Standards:

BOMA (Building Owners & Managers Association) offers widely accepted building operating benchmarks:https://www.boma.org

More reading: Winter-Proof Your Commercial Property: Maintenance Tips That Protect Value

2. Structural Integrity & Environmental Safety

Depending on the property’s age and use, additional environmental and structural reviews may be required.

Most lenders require:

- Phase I Environmental Site Assessment (ESA)

U.S. EPA explains Phase I guidelines here: https://www.epa.gov/brownfields/brownfields-all-about-phase-i-and-phase-ii-environmental-site-assessments

If concerns arise, a Phase II ESA may involve soil, groundwater, or materials testing.

Common triggers for deeper review include:

- Former industrial or automotive use

- Dry cleaners on or near the property

- Nearby rail lines

- Manufacturing or machining history

Structural engineer evaluations are recommended for:

- Large-span warehouse roofs

- Multi-story office conversions

- Any building older than ~40 years

The Quiet Revolution: Transforming Office Spaces Post-Pandemic

3. Confirm Zoning & Planned Use Compatibility

Even if a building fits your needs physically, zoning determines what is legally allowed.

Confirm:

- Zoning classification

- Permitted uses for that zoning type

- Parking & signage requirements

- Buffer & setback restrictions

- Any conditional or special-use approvals required

Reference:

The U.S. Small Business Administration explains zoning and permitted-use categories clearly: https://www.sba.gov/business-guide/plan-your-business/choose-your-business-location

Demystifying Zoning for Commercial Real Estate in Greater Harrisburg, PA

4. Review Title, Boundaries, and Legal Records

Request:

- Title search (to identify liens, easements, or restrictions)

- ALTA survey (to verify boundaries)

- Copies of historical agreements affecting access, parking, or utilities

- Deed review for covenants or use limitations

Why this matters:

Easements, parking allocations, driveway access rights, or shared maintenance agreements can significantly impact utility, future expansion, or redevelopment plans.

5. Evaluate Financial Performance (If the Property Is Leased)

For income-producing or partially-leased properties:

Review:

- Rent roll

- Tenant payment history & creditworthiness

- Lease expirations & renewal options

- Annual rent escalations

- Expense responsibilities (NNN / Gross / Modified Gross)

- CAM reconciliation logs

- Historical occupancy patterns

Industry Insight:

JLL provides global data on CRE tenant performance and lease trends: https://www.jll.com/insights

How to Successfully Negotiate a Commercial Lease: Tips for Tenants and Landlords

6. Analyze Operating Expenses & Utility Load

Request at least 24 months of:

- Electricity usage

- Gas / heating fuel usage

- Water/sewer usage

- Waste removal invoices

- Snow removal, lawn care, and janitorial contracts

This helps forecast true Net Operating Income (NOI) — multiple properties with similar rental rates can have very different cost profiles.

7. Evaluate Market Position & Resale Flexibility

Consider:

- Immediate surrounding uses

- Business growth corridors

- Traffic accessibility

- Proximity to workforce or customers

- Regional development direction

Regional Growth Insight:

The PA Department of Community & Economic Development tracks business expansion and infrastructure planning: https://dced.pa.gov

5 Reasons to Buy Commercial Real Estate in the Greater Harrisburg PA Area

The strongest CRE assets are those that allow multiple future uses.

The Bottom Line

Due diligence is where you protect your investment, improve negotiation leverage, and ensure the property aligns with your goals—not just now, but long-term. It’s not just about checking boxes—it’s about understanding risk, opportunity, and future adaptability.

At The Bill Gladstone Group, we combine local market knowledge, transactional experience, and property-level insight to support informed purchasing decisions at every step.