By Robert A. Abel

Given the COVID-19 crisis, the federal stimulus, and the new presidential administration, many of us are wondering what the future tax landscape will look like. The Biden administration has provided several proposals regarding tax change, which will be discussed in this article. However, it is important to note that the tax concepts discussed here have not yet become official tax law as of the date of this publication.

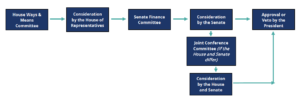

There is a legislative process that all bills, including tax bills, must go through to become law. Here is a basic chart of this process:

President Biden’s administration will present tax bills to become law. Biden has recently made some key political appointments who will comprise his administration. Several of Biden’s Cabinet members and key advisors will be involved in determining future tax policy. Such positions and appointments (some of which may still need confirmation) include:

- Senate Finance Committee: Senator Elizabeth Warren

- Counselor to the Assistant Secretary for Tax Policy: Rebecca Kysar

- Secretary of Treasury: Janet Yellen

- Senate Budget Committee: Senator Bernie Sanders

- Director, National Economic Council: Brian Deese

- Chair, Council of Economic Advisers: Cecilia Rouse

At this time, President Biden has proposed several tax concepts which may or may not become law. These potential changes include:

- An increase in tax rates for the highest income tax bracket. The Biden administration has specified a potential threshold of $400,000 for which the new tax rate (39.6%) would apply. The current rate is 37%.

- An increase in the capital gains tax rate, possibly at ordinary income rates (39.6%) for those with income greater than $1,000,000. The capital gains rate is currently 20%.

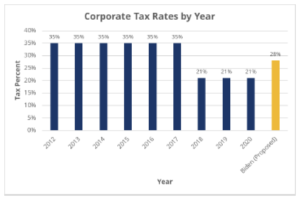

- An increase in the corporate tax rate to 28% from the current 21%.

- A 15% corporate alternative minimum tax on book profits over $100 million.

- An elimination of the step-up basis on inherited assets used for capital gains taxation.

- A reversion of estate and gift tax rates and exemptions back to 2009 levels, which include a $3,500,000 exemption and 45% tax rate.

- A 12.4% Social Security tax for wages below the current wage cap, $142,800, and above $400,000:

o Those earning $0 to $142,800 would be subject to 12.4%.

o Those earning between $142,800 and $400,000 would not be subject to tax.

o Those earning over $400,000 would be subject to 12.4%. For these individuals, half of the tax would be paid by the employer and half by the employee.

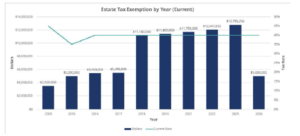

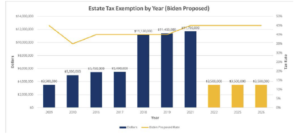

Listed below are charts showing individual income tax rates by year, corporate tax rates by year, and estate tax exemption rates by year to provide a visual representation of what some of President Biden’s proposed tax changes could look like for 2021 and beyond.

Individual Income Tax Rates by Year (Highest Earning Tax Bracket)

Estate Tax Exemption by Year (Current and Biden Proposed)

Author’s note on estate planning: As we consider the possible future changes to estate tax laws, there are several key factors to remember, which include:

- A reduction in the exemption threshold (see charts above).

- An increase in the tax rate (see charts above).

- Clarification from the IRS that there will be no “clawback” for gifts prior to the death of a taxpayer.

Example: Prior to 2018, John Doe never made a taxable gift. In 2018, when the estate exclusion is $11.18 million, John makes a taxable gift of $9 million. John uses $9 million of the available estate exclusion to reduce the gift tax to zero. John dies in 2026. Even if the exclusion is lower that year (say $5 million), John’s estate can still base its estate tax calculation on the higher $9 million of estate exclusion that was used in 2018. Therefore, $4 million of previous gifts would still escape the estate tax.

- It is possible that, due to the current COVID-19 pandemic, valuations of closely held stock could be depressed, which may result in a lower gift amount.

- A proposed IRS law change in 2015 would have limited the discount factor that applies to valuations. This was stopped in 2016 due to the change in the presidential administration. This proposed change could resurface, decreasing the discounts and increasing the valuations used for estate planning.

Corporate Tax Rates by Year

Disclaimer: Information provided by Brown Schultz Sheridan & Fritz (BSSF) is intended for reference and information only. As the information is designed solely to provide guidance, and is not intended to be a substitute for someone seeking personalized professional advice based on specific factual situations, responding to such inquiries does NOT create a professional relationship between BSSF and the reader and should not be interpreted as such. Although BSSF has made every reasonable effort to ensure that the information provided is accurate, BSSF makes no warranties, expressed or implied, on the information provided. The reader accepts the information as is and assumes all responsibility for the use of such information.

Robert A. Abel

Robert A. Abel, CPA, CSEP, is a Principal and Shareholder of Brown Schultz Sheridan & Fritz (BSSF). Bob provides tax, audit and specialty business consulting services to his clients and specializes in assisting privately owned businesses achieve their success.

To learn more about Bob, visit www.bssf.com/our-team/robert-a-abel/

Featured in Harrisburg Commercial Real Estate Report – May 2021