Markets are volatile. Interest rates fluctuate. Stock portfolios swing wildly. In this environment, savvy investors and property owners are asking: Is commercial real estate still a safe bet?

Insights from CCIM’s analysis in “Why Commercial Real Estate Is a Smarter Bet in Today’s Volatile Market” argue emphatically yes — so long as your strategy is grounded, data-driven, and locally informed.

At The Bill Gladstone Group, we believe Harrisburg and the surrounding central PA region are uniquely positioned to benefit from the trends CCIM outlines. Below, we unpack how national arguments translate into local actions — and which of your internal resources can help you execute.

1. Stability & Tangibility: Anchors in Shaky Waters

CCIM argues that one of CRE’s greatest strengths in uncertain times is its tangible nature — it’s real, grounded in physical assets, not abstract. The CCIM Institute compared to equities or market-traded instruments, income-producing real estate offers more control, recurring cash flow, and value tied to local fundamentals rather than macro whims.

Local angle (Harrisburg):

- In Central PA, property appreciation is less volatile than in hypercompetitive coastal metros.

- Lease structures here often allow for longer terms or escalations tied to CPI or operating expenses — giving landlords more cover against inflation.

- For owners or investors nervously watching the stock market, converting a portion of capital into local CRE is a way to rebalance into something predictable and anchored.

To help clients evaluate this, we often point people to our internal resource “Big Opportunities for CRE Investors: Tax Incentives, REIT Growth & Market Trends”, which outlines how to layer stability with upside in today’s deal climate.

2. Income & Yield: The Long-Term Engine

CCIM notes that rent-generating properties (office, industrial, retail, multifamily) provide steady income, plus upside through appreciation and tax benefits. The CCIM Institute

In Central Pennsylvania:

- Industrial / logistics continue to command strong lease rates due to distribution demand along I-81 / I-83.

- Medical office and healthcare-related spaces benefit from demographic tailwinds and stable need.

- Some retail (especially necessity-based) remains resilient, particularly when well located.

If you’re weighing options — whether to lease, hold, or sell — our blog “Key Questions to Ask Before Selling Your Commercial Property” can help you analyze expected yields, risks, and opportunity cost locally.

3. Downside Protection Through Local Insight & Expertise

Risk is always present in real estate — vacancy, rising maintenance, regulatory changes, insurance costs, etc. CCIM’s point is that in CRE, knowledge matters. The more skilled your team, the better you navigate uncertainty. The CCIM Institute

Here’s how that applies in Harrisburg/central PA:

- Understanding zoning, infrastructure, and township trends is crucial. For instance, reading our “What Makes a Township ‘Hot’ for Commercial Investment?” post helps spot where value is shifting before it’s obvious.

- Knowing which lease structures efficiently shift cost burdens (e.g. pass-throughs, triple net, caps) helps protect margins.

- Monitoring macro trends (interest rate moves, inflation, insurance cost escalation) and anticipating their local impacts is part of proactive advising — not reactive scrambling.

4. Riding Macro Shifts: Where CRE Can Outperform

CCIM highlights that in times of equity market turbulence, CRE becomes a compelling alternative — especially for long-term, income-focused capital. The CCIM Institute

Locally, that means:

- Out-of-market investors seeking yield are increasingly looking toward secondary and tertiary markets. Harrisburg can be a sweet spot given lower cost per square foot, favorable land, and transit access.

- Specialty assets — cold storage, flex industrial, life sciences, last-mile logistics — are especially attractive when well positioned.

- Value-add and repositioning play are viable paths: repurposing older office or warehouse stock into new uses (mixed-use, tech-enabled, creative space) can unlock substantial upside.

If you’re interested in positioning for those plays, check out our post “Commercial Real Estate Do’s & Don’ts (Tenant Edition)” — many lessons for owners apply in reverse in adaptive reuses.

5. Putting It All Together: Strategic Steps for Local Execution

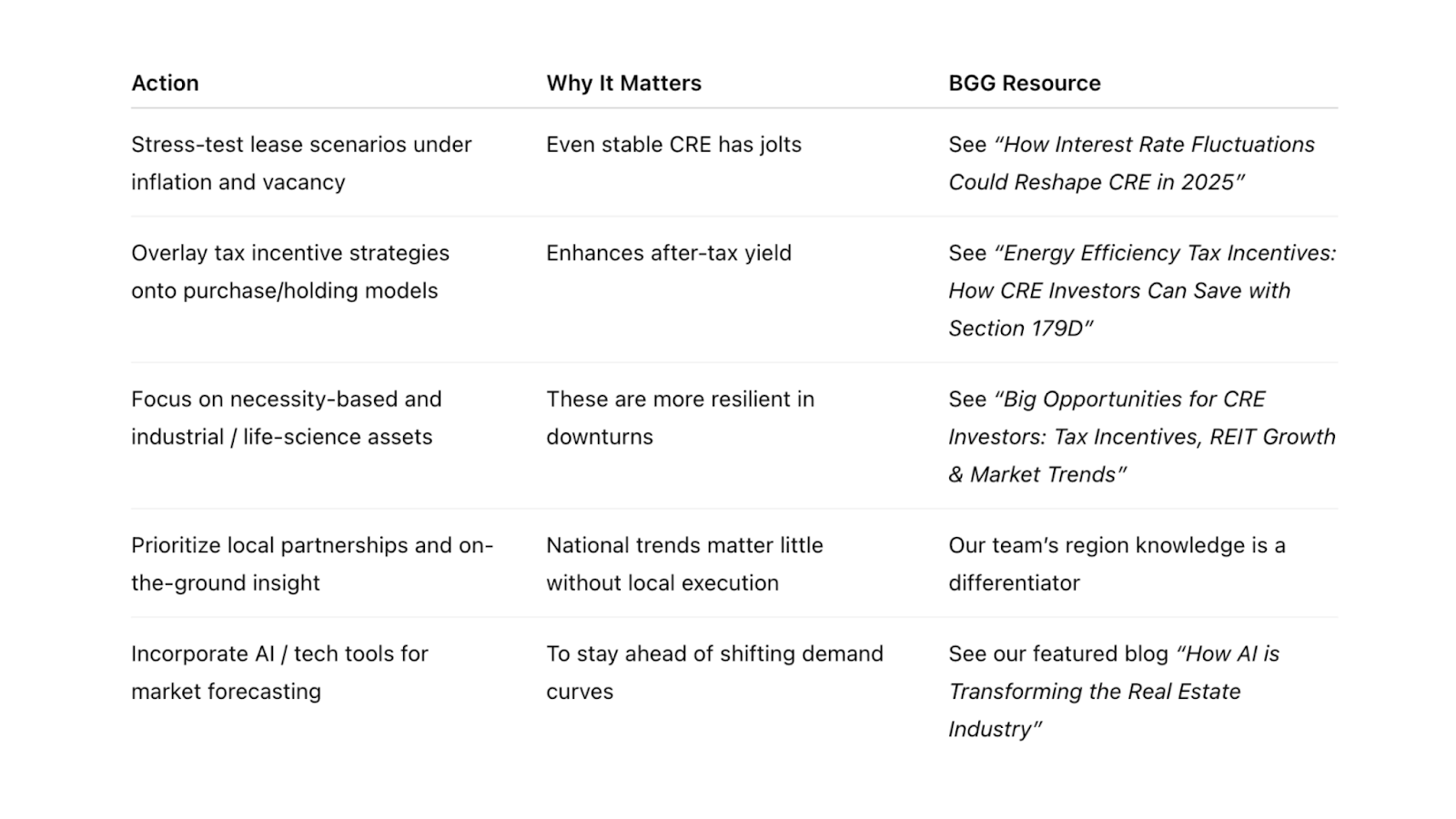

Here’s a checklist for how investors, owners, tenants, and advisors in Harrisburg should act given this environment:

Why Commercial Real Estate Is a Smarter Bet in Volatile Times

Final Thoughts

Volatility in financial markets is unlikely to disappear anytime soon. That’s precisely why thoughtful, data-informed commercial real estate investing is increasingly compelling — especially in markets like Harrisburg where fundamentals remain stable, growth is incremental, and upside is real.

The key isn’t simply jumping into CRE — it’s doing so strategically. With deep local experience, careful underwriting, and a long-term mindset, property owners and investors can use volatility to their advantage rather than be at its mercy.

At The Bill Gladstone Group, we’re here to help you craft, stress-test, and execute those strategies in Central Pennsylvania. When you want to discuss how to apply these principles to your portfolio or next acquisition, just let us know.

Further Reading from Bill Gladstone Group:

How AI Is Transforming the Real Estate Industry

Big Opportunities for CRE Investors: Tax Incentives, REIT Growth & Market Trends

Key Questions to Ask Before Selling Your Commercial Property

What Makes a Township ‘Hot’ for Commercial Investment?